While waiting for Blockchain’s Large Scale Applications

Malcolm Gladwell has a name for successful people that mark their fields and outshine their peers. He calls them “outliers”. While we tend to think of them as utterly gifted people – largely introverted, and living in their heads, Gladwell explains that there is a lot more to the story of success than mere talent and odd looks. Extreme hard-work matters. And so do opportunities. Largely so.

Factually, Vitalik Buterin doesn’t help get past the cliché of genius to say the least. The slightly-awkward-in-public, the “obviously computer geek” using jargon only tech savvy understands, and the cartoonish shirts trump endless all-nighters and years of labor. Despite his young age, the “ Sheldon Cooper ” of crypto has come a long way to co-found Ethereum and unleash the power of distributed ledgers. He is nothing short from an “ outlier ”.

Three years down the road, Ethereum is largely recognized as a public Blockchain and a platform for innovative projects. But little outside the crypto scene understands it. Furthermore, applications outside prototypes, research, and digital money are yet to emerge.

“ Why aren’t there any useful large-scale applications yet ?”

asks Vitalik in a WeChat forum posting “ tough questions ” to the Blockchain community. Well, just like any tough question, there is no simple answer.

How about we start by checking our math like we never did before?

Math for Thoughts – Adoption & Time

Vitalik’s form of question (the use of the word “yet”) comes as no surprise. It’s simple Math at play. Well, not quite simple but rational. In fact, I tried to model the simple adoption of a new technology among a fixed cohort. For a close-knit group of N members, a new technology is up for the taking. Say a smart notebook that converts our crabbed hand notes into Microsoft Word documents for college students.

Let’s name F(t) the function that follows the number of students to adopt the innovative technology (i.e., buy a smart notebook of their own) at any given time t. Initially, F(0)=1 : one early adopter just discovered the awesome gadget and is willing to evangelize his peers for reasons beyond math and science.

The simplest realistic assumption is that every student would get his own gadget only after he has been convinced to do so by a peer (simple ear-to-ear spread of innovation).

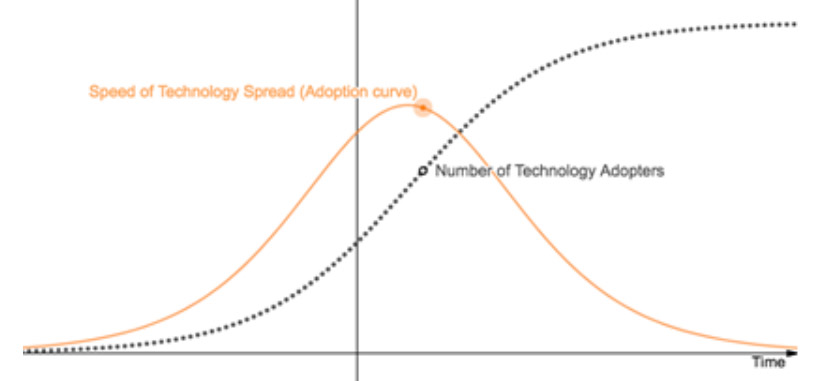

That translates to the following: the number of students (dF) to buy a notebook is a small time interval (dt) is proportional to the number of adopters f. Henceforth this is the equation behind the speed of this technology spread:

dF/dt = A F (N-F)

With A being a positive constant that translates the efficiency that one adopter has to convince a non-adopter. The solution to this question is the number of adopters over time F(t) = N exp(A n t) / (N – 1 + exp(A N t)). Both equations are plotted herewith. The results should be very familiar for our readers with statistic majors: The “bell” curve and the “S” curve.

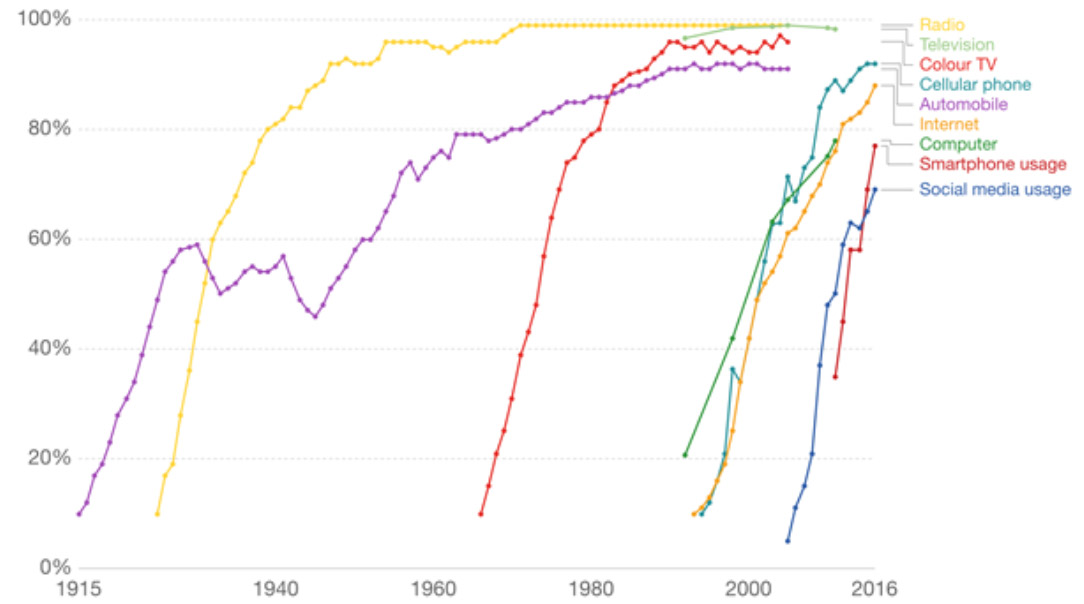

Enjoying the process of integrating and plotting those curves might point me in the direction of a new career path. However, the beauty of this scientific interpretation of a visibly absurd phenomena is greater than my personal revelation. Here are several trends that translate the adoption of a number of technologies from Radio to Cell phones. They all are S-curved like our notebook’s black-dotted-curve.

Rock bottom here, the math suggests that Blockchain adoption needs more time. The technology is still at its infancy and we will have to be patient and actively engaged before reaping real benefits.

However, math alone fails to name the catalysts to an innovation’s spread. As we have seen with many technologies, time merely guarantees an opportunity for growth. It doesn’t suggest success or failure. Just thing Google Glasses … or Segway … or Windows Vista!

Blockchain & Education

It’s fair to say that the entire cryptocurrencies scene is yet to profit from education. Today, there is only one graduate degree program in digital currencies and Blockchain : that of University of Nicosia.

Sure enough, we find Blockchain labs here and there from Berkeley to Duke’s University. Mostly, it’s a way to keep early adopters away from the laggards. It doesn’t help real apps bubble to surface though. As a matter of fact, large scale apps need the hard work, the dedication, and the opportunities Gladwell clearly emphasized in “ outliers ”. Just like Apple needed Steven “iWoz” Wozniak (a highly trained and seasoned IBM engineer) to reach full potential, Blockchain will need seasoned developers of its own. And everyone knows how rare they are today.

This lack of practical knowledge coding decentralized apps (or dApps) is apparent in several projects. Today, most dApps are developed following the same web-development logic. Nowadays, when a vulnerability or a bug appears while testing a software, the administrator is first warned. He proceeds by shutting down the web app for maintenance, fixing the issues on a hunch, then switch back to online mode.

But there is a tremendous lack of knowledge on how to process and handle extremely urgent issues on a decentralized protocol when a maintenance mode is impossible to activate.

We think the solution lies in the governance and a lot of reflexion has to be made to handle such situation.

The Scalability Setback

If there is a second word – after Blockchain – in misinterpretation, it’s scalability. Let’s be clear, the Ethereum and Bitcoin blockchains are public. While Bitcoin’s Blockchain mainly supports a new peer-to-peer cash form, the Ethereum blockchain supports public dApps, enables fundraising events using cryptocurrencies (or Initial Coin Offerings ) and theorizes for a smart-contracts among other uses. Usually, everything that is public needs to withstand heavy use.

Unfortunately, Blockchain is not quite there.

Due to a hard-coded limit on computation per block, Ethereum cannot be decentralized and support more than 20 transactions per second (compared to some 24000 transactions per second for VISA). Without digging deep into technical details, the problem is complex due to systemic Blockchain design. It is decentralized by design with no central authority privileges. It runs full nodes to reach consensus. And getting every node to synchronize an ever growing Blockchain size while maintaining network fluidity is technically challenging.

A typical example concerns micro-payments. It’s like a friend once told me about Ether ($ETH, a digital currency developed as a dApp running on the Ethereum blockchain): “ it’s no real bucks if it buys no Starbucks ”.

Around February 2018 (when Ether reached its record high price), it would have costed more than 10 USD worth of Ether to buy a 4 USD tall late. It would have taken an estimate 10 to 15 minutes of awkward silence at the cashier too before a payment would have been cleared. One could draw an easy conclusion here: scalability is a huge pain-point.

A Gleam of Hope?

Getting to the bottom of the subject clearly demystifies the roadblocks hindering mass adoption stating by viable, big scale uses cases. But it wouldn’t be fair to understate some great advances made in this direction.

For the eager IT geeks among us, partial answers can be found in sharding, segwit or off-chain transactions. For the mere enthusiasts with less technical savvy and more concerns, a new way of approaching community concerns holds great insights. Maybe it’s time to rethink some of the Blockchain’s design features altogether. Maybe we should stop thinking of decentralization as an abruption with everything we once knew about IT architectures and start thinking hybrid architectures. Without pretending to have a one-size-fits-all answer, I’ll leave it to our readers to contemplate and share their insights with us.

For live updates and close community engagement, please join TrustUnion’s social channels